Information is the resolution of uncertainty – Claude Shannon

Case Study: Modelling a Banking Crisis

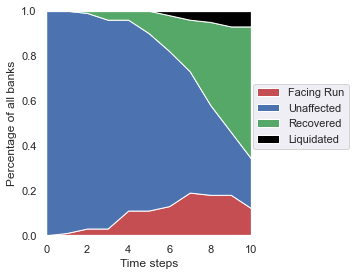

There are striking similarities between banking crises and pandemics. Both can originate from a minor infectious source and can spread very quickly all over the world.

When it comes to banking crises, and to bank runs more specifically, the dominant model for the last four decades is the Diamond & Dibvig model (1983). It deserved its authors the Nobel Prize in 2022. Not a small deal …

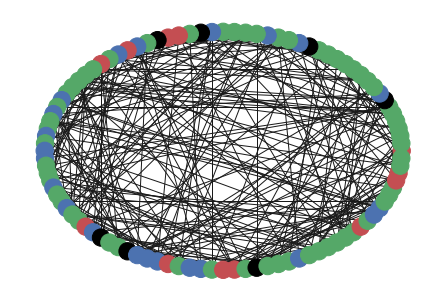

Using the analogy with the propagation of a pandemic, we modeled a banking crisis as a contagion effect within an agent-based model (ABM). Our model has two types of agents: Banks and Customers. Banks are randomly connected in a “small world” Watts–Strogatz network model. Customers react to signals about a bank being safe or not safe. In the latter case, they withdraw their deposits and reallocate them to the remaining safe banks in the system.

ABMs offer fantastic opportunities to develop realistic models of the economy without any macro-rules. They can be scaled to millions of agents depending on the computing resources deployed.